Are your funds stuck in inventory that's still on the water? This long cash-flow gap1 can stall your business growth. Trade finance2 is designed to solve exactly this problem.

Trade finance2 is a set of financial tools3 that help you pay suppliers, manage risk, and improve cash flow. For importers4, it bridges the gap between paying for your goods in China and selling them in the USA, keeping your business running smoothly.

Understanding the theory is one thing. But seeing how it works in a real shipment is what really matters. As a logistics provider, I see importers4 struggle with this every day. It's not just about money; it's about getting your container from the factory to your warehouse without costly surprises. Let's break down how these tools fit into your China-to-USA import process so you can make smarter decisions.

What Is Trade Finance and Why Do Importers Use It?

Paying a Chinese supplier upfront ties up your cash for months. You can't sell goods you don't have, which hurts your business. Trade finance2 provides the funds to bridge this gap.

Importers use trade finance to pay for goods without depleting their working capital5. It helps manage the risk of paying a new supplier and bridges the cash-flow gap1 during the long production and shipping cycle. This ensures your business stays liquid and can continue to operate.

Dive Deeper

When you import a full container load (FCL) from China, your cash conversion cycle6 is long. You might pay a deposit in January, but you won't see the products in your warehouse until April or May. That's four to five months where your money is completely tied up. For a business owner like Mark, a typical client of mine, this is a major pain point. He needs that capital to pay for marketing, staff, and other operational costs.

Trade finance2 is the solution. It’s not just a simple loan. It's a structured way to fund your purchase order. For example, instead of paying your supplier directly from your bank account, a financial institution can step in. They can guarantee the payment to the supplier once certain conditions are met, like providing proof of shipment. This protects you from a supplier who might not deliver. It also gives the supplier confidence to start production. For importers4, it means you keep your cash until the last possible moment, sometimes even after the goods have arrived and been sold.

How Does Trade Finance Work in International Shipping and Imports?

You've placed a huge order, but how does payment fit into the shipping timeline? A wrong step here can delay your container for weeks. Aligning your financing with the shipping process is key.

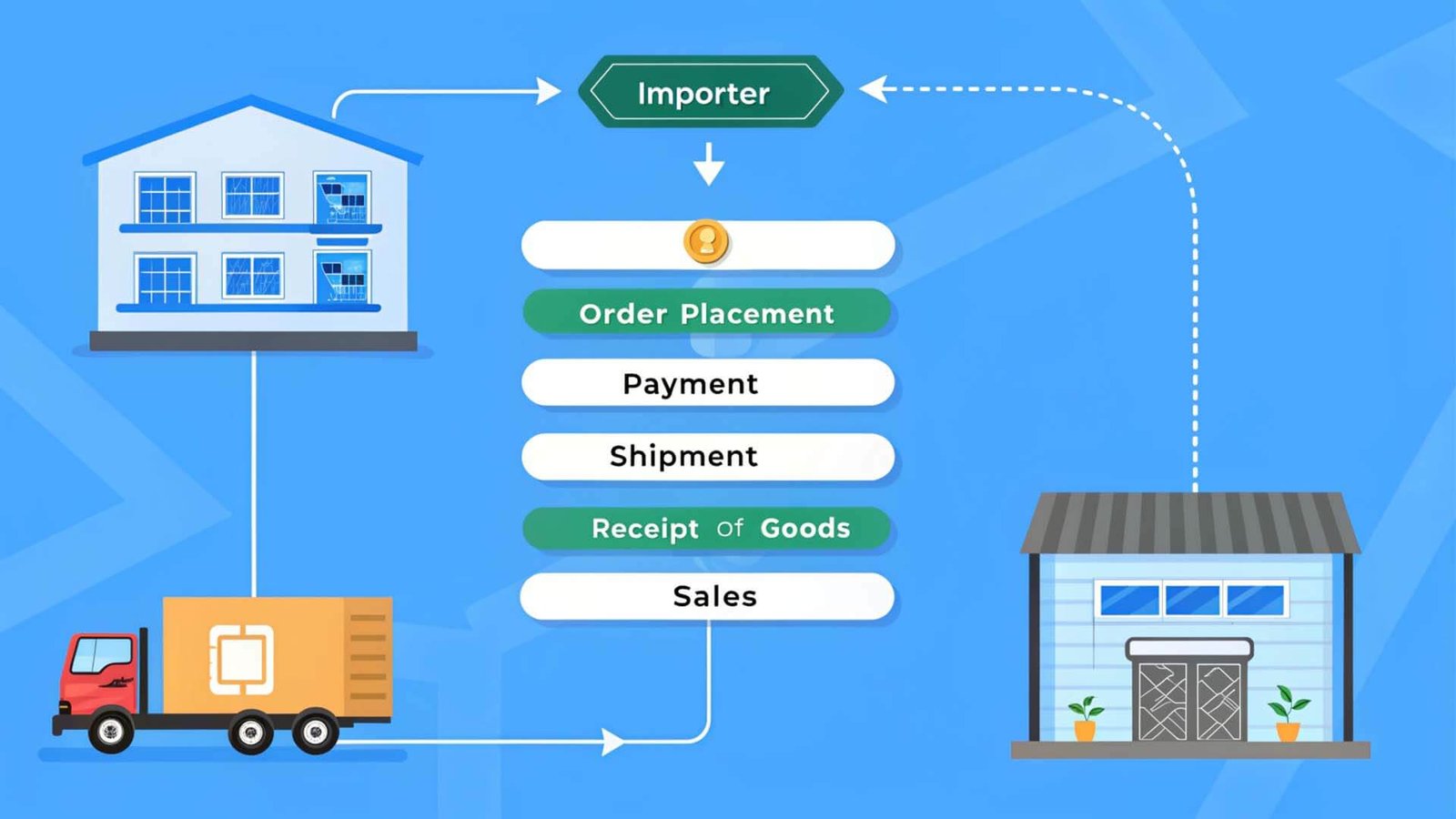

Trade finance2 syncs with your import timeline. It helps you make payments at key stages: a deposit at the Purchase Order (PO), a final payment before shipping, or even after the goods arrive. This alignment prevents expensive delays at the port.

Dive Deeper

Let's walk through a real China → USA FCL import scenario to see where finance fits in.

-

Purchase Order (PO) & Deposit: You agree to buy a container of goods. The supplier usually asks for a 30% deposit to begin production. Instead of using your cash, you could use a trade finance facility to make this initial payment.

-

Production: The supplier uses the deposit to buy raw materials and manufacture your products. This can take 30 to 60 days. Your money is working, but your goods are still in the factory.

-

Pre-Shipment & Final Payment: Production is finished. The supplier now wants the remaining 70% before they release the goods to the port. This is a critical financing point. A Letter of Credit7, for example, would pay the supplier automatically once they provide the shipping documents to the bank.

-

Ocean Transit: The container is on a vessel for about 30 days. Your cash is literally "on the water."

-

Customs Clearance: The ship arrives. Now, U.S. Customs duties and taxes are due. Your customs broker, like my team, needs the official documents (like the Bill of Lading) to clear the shipment. If your financing arrangement delayed payment to the supplier, they might hold those documents. This is how you get stuck with demurrage and storage fees8, which can cost hundreds of dollars a day.

-

Final Delivery: After clearing customs, the container is delivered to your warehouse. Only now can you start selling the goods and making your money back.

Common Trade Finance Tools Importers Actually Use (LC, OA, Factoring)?

You hear terms like LC, TT, and OA, but they're confusing. Choosing the wrong one can cost you money or even your shipment. Let's clarify the most common tools for China importers4.

The most common tools are Letters of Credit (LCs), which are bank-guaranteed payments; Telegraphic Transfer9s (TT), direct wire payments; and Open Account10s (OA), where you pay after receiving goods. Each offers a different balance of risk, cost, and cash-flow impact.

![]()

Dive Deeper

For my clients importing from China, the choice of payment tool is a huge decision. It's about balancing trust, risk, and cash flow. Here are the ones that really matter:

-

Letters of Credit (LC): Think of an LC as a promise from your bank to pay the supplier on your behalf. The bank only pays when the supplier provides specific documents, like the Bill of Lading, proving they shipped the goods as agreed. This is very secure for both you and the supplier. However, it's complex, slow, and banks charge significant fees. I usually see this used for very large orders or with brand-new suppliers.

-

Telegraphic Transfer9 (TT): This is the most common method I see. It’s a simple wire transfer. The standard terms are 30% deposit to start production and 70% payment before the container is shipped. It's fast and cheap, but it carries risk for the importer. You are trusting the supplier with your money before you have the goods.

-

Open Account10 (OA): This is the best deal for an importer. You pay the supplier 30, 60, or even 90 days after you receive the goods. This gives you amazing cash flow. But it's very risky for the supplier, so it's only offered to long-term, high-volume buyers with a lot of trust.

Here is a table to help you compare:

| Feature | Letter of Credit7 (LC) | Telegraphic Transfer9 (TT) | Open Account10 (OA) |

|---|---|---|---|

| Payment Timing | After shipment, upon document presentation | Before shipment (usually 30% deposit, 70% final) | After delivery (e.g., Net 30/60 days) |

| Importer Risk | Low (Bank verifies documents) | High (Paying before you get goods) | Very Low (Pay after inspection) |

| Supplier Risk | Very Low (Bank guarantees payment) | Medium (Risk of buyer backing out) | High (Risk of non-payment) |

| Cash-Flow Impact | Good (Pay after shipment) | Poor (Cash is tied up early) | Excellent (Pay from sales revenue) |

| Typical Use Case | Large orders, new suppliers, high-risk deals | Most common for established relationships | Long-term, trusted partners |

Trade Finance Risks Importers Must Understand Before Using It?

Trade finance2 seems like a perfect solution, but it has hidden risks. Ignoring them can lead to lost money and delayed goods sitting at the port. You must know the pitfalls before you commit.

The main risks include supplier non-performance11 (they take the money and don't ship), document discrepancies12 that block payment, currency fluctuations13, and miscalculating the timing for duty payments14. Understanding these risks is crucial to protecting your investment.

Dive Deeper

I've seen these risks turn profitable shipments into financial disasters. Here’s what to watch out for:

-

Supplier Non-Performance: This is the biggest fear when using a Telegraphic Transfer9 (TT). I had a client who paid a 30% deposit to a new supplier found online. The supplier disappeared. The money was gone, and there were no goods. This is why using a secure method like an LC or working with a verified supplier is so important for new relationships.

-

Document Discrepancies: This is the classic LC nightmare. Your Letter of Credit7 has very strict rules. If the supplier's address on the invoice has a typo, or the Bill of Lading is off by one detail, the bank can legally refuse to pay. This leaves you, the importer, in a terrible spot. The supplier wants their money, but the bank won't pay, and your container is stuck at the port while you sort it out.

-

Payment Timing vs. Customs Clearance: This is a common and costly mistake. Say you agreed to pay your supplier after the goods arrive in the USA. But to clear U.S. Customs, your broker needs the original Bill of Lading. The supplier will not release that document until they are paid. Every day your container sits at the port waiting for that document, you are charged demurrage and storage fees8. These can easily add up to thousands of dollars.

-

Currency and Duty Exposure: Your purchase order is in USD, but the duty rate you planned for suddenly changes. Or the cost of financing was higher than you budgeted. These surprises can destroy your profit margin. Good planning means accounting for these variables in your total landed cost from the very beginning.

How Trade Finance Supports Cash Flow for China → USA Imports?

Your cash is tied up for months between paying your supplier and selling your goods. This painful cash crunch limits your growth and ability to seize opportunities. Smart financing can shorten this cycle.

Trade finance2 directly supports cash flow by bridging the gap between paying your Chinese supplier and receiving payment from your US customers. It lets you pay for goods, duties, and freight without using your own capital, freeing up money for operations.

Dive Deeper

Let's get practical. The ultimate goal is to shorten your cash cycle. If you use an Open Account10 (OA) and pay your supplier 60 days after delivery, you can sell the inventory and use that revenue to pay for it. Your own cash is never tied up. This is the dream scenario. On the other hand, using a 100% upfront TT payment means your cash is gone for months before you can even start selling.

What about DDP (Delivered Duty Paid)15 shipping? Many importers4 think DDP solves their cash flow problems because the seller handles shipping and duty payments14. This is a misunderstanding. With DDP, the seller is the one financing the duties and freight, but they build that financing cost directly into your price. You are still paying for it. DDP shifts the responsibility, but it doesn't eliminate the financial pressure; it just hides it in a higher unit cost.

Proper trade finance planning helps you calculate your true Total Landed Cost16. An expensive LC adds to your cost per unit. Getting a cheaper price from a supplier might require a risky TT payment. My most successful clients work with their customs broker and freight forwarder17 to align their financing with the physical shipment, ensuring funds are ready for duties the moment the container arrives. This prevents delays and keeps their supply chain18 moving.

Conclusion

For China → USA FCL imports, trade finance is not just a banking function. It is a critical part of import execution, duty planning, and landed-cost control, especially under DDP terms.

Managing cash-flow gaps is crucial for business growth, and learning strategies can prevent financial bottlenecks. ↩

Understanding trade finance can help you manage cash flow and risk in international trade, ensuring smooth business operations. ↩

Exploring financial tools can provide solutions to pay suppliers and manage risks efficiently. ↩

Understanding why importers rely on trade finance can reveal its benefits in maintaining liquidity and operational continuity. ↩

Trade finance can help importers maintain working capital, crucial for funding other business operations. ↩

Learning about the cash conversion cycle can help businesses optimize their financial operations and reduce cash flow issues. ↩

A Letter of Credit can secure transactions, providing assurance to both importers and suppliers. ↩

Avoiding demurrage and storage fees can save importers significant costs and prevent shipment delays. ↩

Understanding Telegraphic Transfer can help importers make informed decisions about payment methods. ↩

An Open Account can offer favorable cash flow terms, but it's important to understand its risks and benefits. ↩

Mitigating supplier non-performance is crucial to avoid financial losses and ensure timely delivery of goods. ↩

Avoiding document discrepancies can prevent payment delays and ensure smooth import operations. ↩

Understanding currency fluctuations can help importers manage financial risks and protect profit margins. ↩

Understanding duty payments can help importers budget accurately and avoid unexpected costs. ↩

Understanding DDP shipping can help importers make informed decisions about shipping terms and costs. ↩

Calculating Total Landed Cost is essential for pricing strategies and understanding the true cost of imports. ↩

Freight forwarders can streamline shipping processes, making them essential partners for importers. ↩

Trade finance can enhance supply chain efficiency by ensuring timely payments and reducing financial bottlenecks. ↩