You received a freight quote for $2,800 per container1 from China to Los Angeles. Your cargo arrives, and suddenly you face $1,200 in unexpected destination charges2.

Origin and destination charges are local port fees3, handling costs4, and documentation charges5 that exist outside the base ocean freight rate6. These charges can add 30-50% to your total shipping cost and vary significantly based on your chosen Incoterm, creating major budget surprises for unprepared U.S. importers.

After 15 years helping U.S. importers navigate China-to-USA shipping, I have seen countless companies get blindsided by these additional costs. The problem is not the charges themselves—they are legitimate business expenses. The issue is poor cost visibility7 and Incoterm selection8 that shifts financial risk to buyers at the worst possible moment.

What Origin and Destination Charges Really Are in International Shipping—and Why U.S. Importers Get Surprised by Them?

You think you bought ocean freight, but you actually bought ocean transportation only. Origin and destination charges are the mandatory local costs that occur before your container boards the vessel and after it arrives at the destination port.

Origin and destination charges are port handling fees, documentation costs, and local transportation charges that shipping lines and port authorities collect separately from the base ocean freight rate6. U.S. importers get surprised because these charges appear on separate invoices and vary significantly based on port conditions9, carrier policies10, and Incoterm selection8.

The base ocean freight rate6 covers vessel space and transportation between ports. Everything else costs extra. At origin ports in China, you pay terminal handling charges11, documentation fees, and export processing costs. At destination ports in the United States, you pay similar handling fees plus customs clearance12, ISF filing13, and potential examination charges14.

Here is why importers consistently underestimate these costs. Freight forwarders often quote "freight only" rates to win business. They know buyers focus on the largest line item—the ocean freight. The smaller charges get disclosed later, often after your cargo has already shipped and you have no negotiating power.

Port conditions make these charges unpredictable. During peak seasons or port congestion15, handling fees increase. Examination rates rise during heightened security periods. Currency fluctuations affect charges denominated in foreign currencies. Your $2,800 freight rate stays fixed, but your $800 in destination charges can easily become $1,200.

The transparency problem gets worse with FOB shipments16. Your supplier arranges origin charges in China, but you receive bills for destination charges weeks later from multiple vendors—your freight forwarder, customs broker, trucking company, and sometimes the port authority directly. Each invoice arrives separately, making total cost tracking nearly impossible until after delivery.

Most importers discover their true shipping costs only after completing several shipments. By then, they have already committed to supplier relationships, customer pricing, and margin expectations based on incomplete cost information. This creates ongoing profitability pressure that many companies never fully resolve.

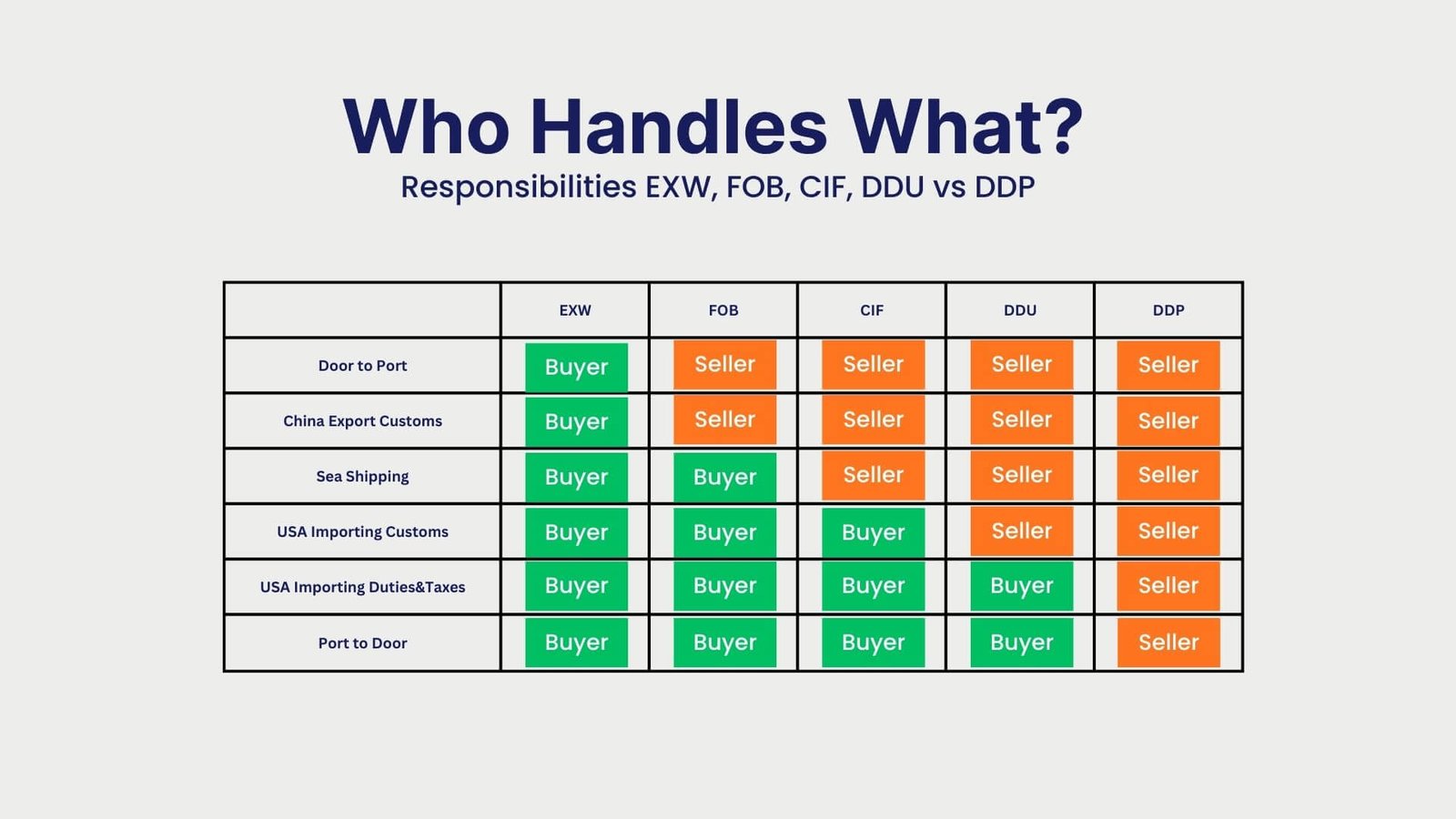

Who Pays Origin and Destination Charges Under FOB, CIF, CFR, DAP, and DDP Incoterms?

Your Incoterm choice determines who pays which charges and when payment occurs. This decision directly impacts your cash flow, cost predictability, and relationship with suppliers and service providers.

Incoterms determine cost responsibility by establishing the point where risk and cost transfer from seller to buyer. FOB makes buyers responsible for all destination charges, while DDP makes sellers responsible for all charges through final delivery, creating vastly different cost exposure levels for U.S. importers.

Understanding cost allocation prevents disputes and budget surprises. Each Incoterm creates a different financial structure that affects your relationship with suppliers, service providers, and customers.

| Incoterm | Who Pays Origin Charges | Who Pays Destination Charges | Who Controls Customs | Risk Level for U.S. Importer |

|---|---|---|---|---|

| FOB | Seller (China supplier) | Buyer (U.S. importer) | Buyer | High - no cost control after departure |

| CIF | Seller (China supplier) | Buyer (U.S. importer) | Buyer | High - insurance included but still no destination cost control |

| CFR | Seller (China supplier) | Buyer (U.S. importer) | Buyer | High - similar to FOB without insurance |

| DAP | Seller (China supplier) | Seller (China supplier) | Buyer | Medium - seller pays delivery but buyer handles customs |

| DDP | Seller (China supplier) | Seller (China supplier) | Seller | Low - seller responsible for all costs and customs |

FOB creates the highest cost uncertainty because responsibility transfers at the origin port. Your supplier handles origin charges, but you become responsible for everything afterward—ocean freight, destination charges, customs clearance12, and delivery. You lose cost control the moment your container leaves China.

CIF and CFR offer minimal improvement over FOB. The seller pays ocean freight and sometimes insurance, but you still handle all destination charges and customs clearance12. These Incoterms create a false sense of security because the major cost uncertainty remains on your side.

DAP shifts more responsibility to the seller, who must deliver your cargo to your specified location. However, you still handle customs clearance12, duties, and any examination fees. This creates coordination challenges and potential delays if customs issues arise.

DDP provides maximum cost predictability17 because the seller handles everything through final delivery. Your supplier quotes one price that includes all charges, customs clearance12, duties, and delivery to your warehouse. This eliminates invoice surprises and simplifies your accounting processes.

The risk level reflects your exposure to unexpected costs and operational problems. Higher risk means more potential for budget overruns, delivery delays, and supplier disputes. Lower risk means better cost predictability and smoother operations.

The Most Common Origin and Destination Charges That Increase Landed Cost for U.S. Importers?

Certain charges appear on almost every shipment, while others depend on cargo type, port conditions9, and examination requirements. Understanding typical charge ranges helps you budget accurately and negotiate better terms.

Terminal handling charges, documentation fees, customs clearance12 costs, and ISF filing13 fees represent the most common charges that increase landed cost18. These charges typically add $800-1,500 per container for China-to-USA shipments, with examination fees and port congestion15 potentially doubling these costs during peak periods.

Origin charges in China typically include terminal handling charges11 (THC) of $100-200 per container, export documentation fees of $50-100, customs clearance12 at origin of $80-150, and trucking to port of $100-300 depending on distance. VGM (Verified Gross Mass) certification adds another $25-50. These charges total $355-800 per container under normal conditions.

Chinese ports add surcharges during peak seasons, typically October through February. Port congestion fees can add $200-500 per container. Currency adjustment factors (CAF) and bunker adjustment factors (BAF) create additional variability. Emergency security surcharges appear during geopolitical tensions.

U.S. destination charges include terminal handling charges11 of $400-600 per container, ISF filing13 fees of $25-75, customs clearance12 of $125-200, and examination fees of $300-800 if selected. Port fees vary by location—Los Angeles and Long Beach typically cost more than East Coast ports. Chassis usage, if required, adds $150-300.

Delivery charges depend on distance and local market conditions. Local trucking within 50 miles typically costs $200-500 per container. Detention and demurrage fees apply if you exceed free time at the port or with equipment. These fees start at $75-150 per day and escalate quickly.

Examination fees create the biggest cost uncertainty. U.S. Customs examines 3-5% of containers under normal conditions, but this rate increases for new importers, high-risk commodities, or heightened security periods. Physical examinations cost $300-500, while intensive examinations can reach $800-1,200. X-ray examinations typically cost $150-300.

Port storage fees apply if your cargo sits at the terminal beyond free time, usually 3-5 days. Storage fees start at $25-50 per day and increase after the first week. During port congestion15, free time may be reduced and storage fees increased.

Some charges are negotiable, others are not. Ocean freight rates, customs brokerage fees, and trucking rates can be negotiated based on volume and relationship. Port authority fees, examination fees, and government-mandated charges cannot be negotiated. Understanding which costs are fixed versus variable helps you focus negotiation efforts effectively.

Why FOB Shipments Create the Highest Risk of Unexpected Destination Charges for Buyers?

FOB transfers cost responsibility at the origin port, leaving buyers exposed to all charges that occur after vessel departure. This timing creates maximum uncertainty because most variable costs occur at the destination.

FOB shipments16 create high risk because buyers become responsible for all destination charges—customs clearance12, port fees, examinations, and delivery—without advance cost visibility7. Since most variable shipping costs occur at destination ports, FOB buyers face the greatest exposure to unexpected charges and budget overruns.

The fundamental problem with FOB is timing. Your supplier quotes origin charges they control, but you pay destination charges you cannot predict or negotiate until after your cargo ships. This creates a gap between purchase decisions and cost reality that many importers never fully bridge.

Consider a typical FOB transaction. Your Chinese supplier quotes $2,800 per container FOB Shanghai. This seems competitive compared to a $3,600 DDP quote from another supplier. You choose FOB to save money. Three weeks later, you receive invoices totaling $1,400 for destination charges—customs clearance12, port fees, trucking, and an unexpected examination. Your "cheaper" FOB shipment actually costs $4,200, making it more expensive than the DDP alternative you rejected.

FOB splits service providers in a way that maximizes disputes. Your supplier arranges origin services in China using their relationships and language advantages. You arrange destination services in the United States using different companies with different pricing structures and service levels. When problems occur, finger-pointing between origin and destination service providers creates delays and additional costs.

| Cost Category | FOB: Who Pays & When | DDP: Who Pays & When | Cost Predictability |

|---|---|---|---|

| Origin handling | Supplier pays upfront | Supplier pays upfront | High - known at purchase |

| Ocean freight | Buyer pays after departure | Supplier quotes upfront | FOB: Medium, DDP: High |

| Destination handling | Buyer pays after arrival | Supplier quotes upfront | FOB: Low, DDP: High |

| Customs clearance | Buyer pays after clearance | Supplier quotes upfront | FOB: Low, DDP: High |

| Delivery | Buyer arranges separately | Supplier quotes upfront | FOB: Low, DDP: High |

| Examinations | Buyer pays if selected | Supplier quotes upfront | FOB: Very Low, DDP: High |

Cash flow timing works against FOB buyers. You pay your supplier based on incomplete cost information, then receive additional invoices weeks later from multiple U.S. service providers. This creates accounts payable complexity and makes accurate margin calculations nearly impossible until after delivery.

Freight forwarders have legal authority to collect destination charges from FOB consignees. When you become the importer of record, you become liable for all charges necessary to clear and deliver your cargo. Refusing to pay legitimate charges can result in cargo holds, storage fees, and potential seizure.

The cost uncertainty compounds during disruptions. Port strikes, weather delays, equipment shortages, and examination backlogs all increase destination charges. Since these events are unpredictable and occur after your FOB purchase decision, you have no recourse except to pay additional costs or abandon your cargo.

Many importers choose FOB because origin quotes appear cheaper, but they fail to account for destination charge variability. A $200 difference in quoted freight rates becomes meaningless when destination charges vary by $800-1,200 based on port conditions9 and examination requirements.

How U.S. Importers Avoid Hidden Origin and Destination Charges With Better Incoterm and Shipping Structure?

Prevention requires choosing Incoterms that align with your cost certainty needs and working with service providers who quote comprehensive landed cost18s rather than freight-only rates.

U.S. importers avoid hidden charges by requesting DDP quotes that include all costs through delivery, requiring detailed charge breakdowns before shipping, and establishing relationships with freight forwarders19 who provide transparent, all-inclusive pricing rather than freight-only quotes that exclude destination charges.

Start with Incoterm selection8 that matches your risk tolerance and operational capabilities. If you need cost predictability and simplified operations, choose DDP despite higher quoted prices. The price difference often disappears when you account for hidden FOB charges, and you eliminate the operational complexity of managing multiple service providers.

Request comprehensive quotes that itemize all charges. A proper DDP quote should show ocean freight, origin charges, destination charges, customs clearance, duties, and delivery as separate line items. This transparency allows you to understand what you are paying for and compare quotes accurately between suppliers and service providers.

Establish relationships with freight forwarders who specialize in your trade lane and cargo type. China-to-USA specialists understand typical charge ranges and can provide more accurate estimates than generalists. They also have better relationships with carriers and service providers, often resulting in lower actual costs.

Build charge variability into your budgeting process. Even with DDP terms, some costs fluctuate based on port conditions, examination rates, and seasonal factors. Budget an additional 10-15% above quoted charges to account for these variables. This prevents margin erosion when actual costs exceed estimates.

Negotiate annual contracts for predictable volumes. Freight forwarders and customs brokers offer better pricing and service guarantees for committed volumes. Annual contracts also lock in charge structures, reducing mid-year price increases and surcharge surprises.

Use this checklist before booking any shipment:

- Confirm Incoterm responsibility for all charges

- Request itemized quotes including all potential fees

- Verify customs clearance and delivery arrangements

- Establish maximum charge limits for examinations

- Confirm free time allowances at origin and destination

- Review insurance coverage and claim procedures

- Establish communication protocols for delays or issues

- Confirm invoicing and payment terms with all parties

Monitor actual costs against quotes for continuous improvement. Track charge variations by month, port, and service provider to identify patterns and negotiate better terms. Use this data to refine your budgeting process and supplier negotiations.

Consider consolidating services with fewer providers. Using one company for freight forwarding, customs clearance, and delivery simplifies coordination and often reduces total costs. Single-source providers have better visibility into your supply chain and can optimize routing and timing to minimize charges.

Document charge agreements in writing before shipping. Email confirmations of maximum charges, free time allowances, and service levels prevent disputes and provide recourse when actual charges exceed agreements. This is especially important for examination fees and storage charges that can escalate quickly.

Conclusion

Origin and destination charges represent 25-40% of total China-to-USA shipping costs, making Incoterm selection and service provider transparency critical for accurate budgeting and profitable operations.

Frequently Asked Questions

What are origin and destination charges in shipping? Origin and destination charges are local port fees, handling costs, and documentation charges that exist outside the base ocean freight rate. These include terminal handling, customs clearance, and delivery charges that can add $800-1,500 per container.

Who pays destination charges for FOB shipments? The buyer (U.S. importer) pays all destination charges for FOB shipments, including port fees, customs clearance, examinations, and delivery costs. This creates cost uncertainty because these charges are not known until after the cargo ships.

Why do FOB shipments often have hidden destination fees? FOB transfers cost responsibility to buyers at the origin port, but most variable charges occur at destination ports. Buyers receive separate invoices from multiple providers weeks after shipping, making total cost prediction nearly impossible.

Is DDP more expensive than FOB for U.S. importers? DDP quotes appear higher but often cost less than FOB when accounting for all charges. DDP eliminates hidden fees, reduces operational complexity, and provides complete cost predictability through final delivery.

Which Incoterm offers the most predictable landed cost? DDP (Delivered Duty Paid) offers the most predictable landed cost because the seller handles all charges, customs clearance, and delivery. This eliminates cost surprises and simplifies accounting processes for U.S. importers.

Understanding typical freight quotes helps you compare and negotiate better shipping rates. ↩

Avoiding unexpected charges can save you from budget overruns and financial surprises. ↩

Knowing about local port fees helps you anticipate additional costs in your shipping budget. ↩

Understanding handling costs can help you manage and reduce your overall shipping expenses. ↩

Documentation charges are essential to understand for accurate budgeting and compliance. ↩

Knowing what the base rate covers helps you identify additional costs that may arise. ↩

Improving cost visibility can help you avoid unexpected expenses and improve budgeting. ↩

Choosing the right Incoterm can significantly impact your shipping cost and risk exposure. ↩

Understanding port conditions can help you anticipate changes in shipping costs. ↩

Carrier policies can affect your shipping rates and terms, impacting your overall costs. ↩

Terminal handling charges are a common cost that can impact your shipping budget. ↩

Understanding customs clearance can help you avoid delays and additional costs. ↩

ISF filing is crucial for compliance and avoiding penalties in U.S. imports. ↩

Minimizing examination charges can reduce your overall shipping costs. ↩

Port congestion can lead to increased costs and delays, impacting your supply chain. ↩

Understanding the risks of FOB can help you choose better shipping terms. ↩

Choosing DDP can simplify budgeting and reduce the risk of unexpected charges. ↩

Knowing your landed cost helps in accurate pricing and profitability analysis. ↩

Freight forwarders can help manage logistics and reduce shipping complexities. ↩